Make the most of your long-term investment

The Instant Asset Write Off – what is it and how can your business utilise it?

- Federal Government confirmes that the write-off threshold would be lifted to $150,000 and extended to businesses with a turnover of up to $500 million, from $50 million.

- The cut-off date to take advantage of the increased limit is June 30.

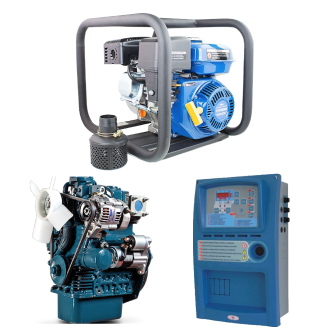

- New and used generators, welders, air compressors, pumps,fuel cells and load banks can be written off.

- This new measure is expected to decrease taxes paid by Australian businesses by $2.5billion over the next two years.

What does this actually mean?

- Deductions are available for machines purchase that are made by your business, for your business.

- The purpose of the $150,000 Instant Asset Write Off is to accelerate the speed at which you can make deductions for those purchases.

- Small businesses (ATO definition of small business) have been able to instantly deduct business assets that cost $150,000 or less.

- Business owners can claim a deduction for that asset in the same income year as the asset was purchased. This deduction is then able to be claimed on the business’s tax return for that income year.

How is this different to the previous Asset deduction rules?

- May 12th, 2015, businesses were only able to instantly write off assets up to $1,000. Assets that exceeded $1,000 were only able to be written off partially every year, in accordance with the relevant depreciation rate for the class of asset.

- Since the introduction of the $150,000 Instant Asset Write Off, businesses can now write off the cost of the asset (providing it is $30,000 or under) in the same financial year as they bought it instead of the ongoing depreciation rules that previously applied (and still do apply to assets that cost greater than $150,000).

What about items that cost more than $150,000?

- Machines that you have purchased in this income year that are greater than $150,000 can be allocated to a pool, and then be depreciated and deducted – albeit at different rates.

- Check with your Accountant or Tax Advisor for more information on your individual circumstances.

Does this mean I get a $150,000 tax refund for each asset?

- The $150,000 Instant Asset Write Off scheme means that you can reduce the amount of tax that your business has to pay.

- If your business is structured as a “company”, the most you would “get back” would be the current company tax rate of 27.5%.

Additional points to consider before rushing out to purchase Assets

Assets must be ready to use:

- To be eligible to write off your new generator, it must be either installed and in-use, or purchased and ready for use in the same financial year as it was purchased.

- This means that you can’t claim the $150,000 Instant Asset Write Off for a purchase that was finalized in June 2018, but that won’t be installed or operation until September 2018, for example.

How long will the Instant Asset Write Off be available?

- There is no guarantee, however, that the Government will continue the scheme in the 2020/21 financial year, so this could be the final year of the increased $150,000 threshold before being reduced back to the original $1,000 cap.

Does every “Small Business” qualify?

- The write off is only available to small businesses with an aggregate turnover of less than $50,000,000.

- The entity that is purchasing the generator must be trading business – meaning that the entity conducts business in its own right.

Is it wise to invest now to take advantage of the Instant Asset Write Off?

- It may be wise for you to take advantage of the $150,000 Instant Asset Write Off if your business has the cash flow to support the purchase/s.

- If you act soon Genelite can have the asset either operational or ready for use in this financial year.

- Genelite offers various finance options for Australian businesses, including trade finance, invoice finance and debtor finance.

Need guidance?

Talk to Ricky, he’ll point you in the right direction.

Ricky Wilkie

Business Development l Genelite Pty Ltd

P: 1300 305 912

E: sales@genelite.com.au l W: www.genelite.com.au

The information provided on this website is general in nature only and does not constitute personal or commercial financial or taxation advice. The information has been prepared based on our interpretation of the IAWO program and has not taken into consideration your personal or business objectives, financial situations or needs. Before acting on any information on this website, or others, you should consider the appropriateness of the information with regard to your personal or business objectives, financial situations or needs. Speak to your Accountant, Tax Advisor or the Australian Tax Office for any questions you may have with regard to the application of the Instant Asset Write Off for your business.

Source:

- https://www.ato.gov.au/Business/Depreciation-and-capital-expenses-and-allowances/Simpler-depreciation-for-small-business/Instant-asset-write-off/

- https://www.ato.gov.au/business/depreciation-and-capital-expenses-and-allowances/in-detail/depreciating-assets/simplified-depreciation—rules-and-calculations/?page=2#Excluded_assets